Trust

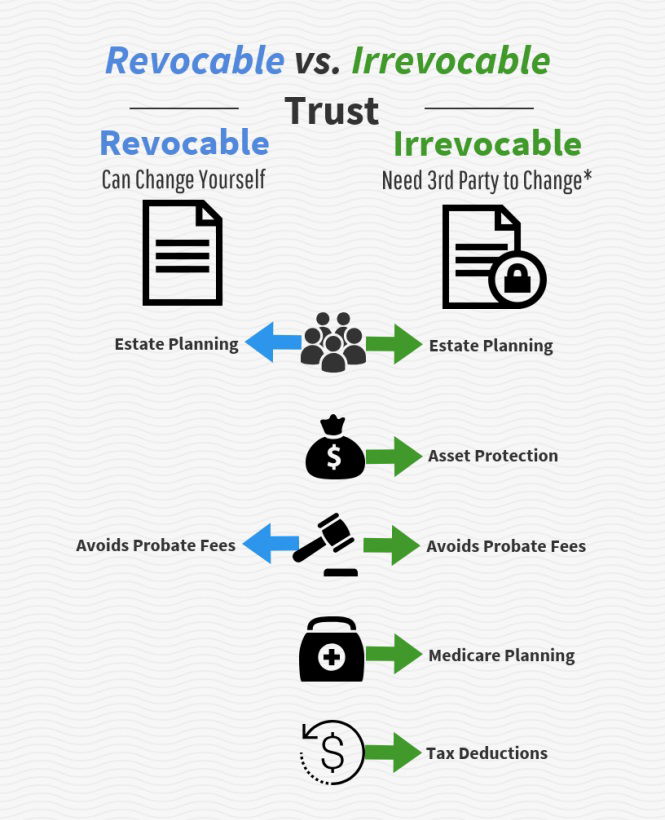

Revocable vs. Irrevocable Trusts

Revocable vs. Irrevocable Trusts

A revocable trust, commonly a revocable living trust, is an estate planning tool that a settlor can change at any time. So, if your needs change you can make amendments freely without the interaction of a third-party.

So, why doesn’t everybody set up a trust that is revocable as opposed to an irrevocable trust? There are several reasons.

- A revocable living trust is part of your own estate for asset protection purposes. As such, it offers no asset protection from creditors or those who seek to sue you.

- It also offers no segregation of assets in order to qualify for support such as Medicaid or disability assistance.

- Plus, upon your death, assets in the trust are also yours for state and federal estate tax purposes.